Tuition Rates by Year, Credits, Course Type, and Residency Status

Learn about tuition and fee rates at Bellevue College.

General Information

Tuition and fee rates are set by the Washington State Legislature and regulated by the State Board for Community and Technical Colleges (SBCTC). Tuition and fees are subject to change and are also approved by the college Board of Trustees.

2020 – 2021 rates are approved and effective starting Fall quarter 2020

| Lower Division Courses (299 & below) | Upper Division Courses (300 & above) | |||

|---|---|---|---|---|

| Credits | Resident | Non-Resident | Resident (State-Support) | Non-Resident |

| 1-10 | $113.04 per credit | $291.28 per credit | $220.51 per credit | $620.30 per credit |

| 11-18 | $1,130.40 for first 10 credits plus $55.94 per credit 11-18 | $2,912.80 for first 10 credits plus $63.22 per credit 11-18 | $2,205.10 for first 10 credits plus 11.04 per credit 11-18 | $6,203.00 for first 10 credits plus 11.84 per credit 11-18 |

| 19+ | $101.42 per additional credit beyond 18 | $279.66 per additional credit beyond 18 | $208.89 per additional credit beyond 18 | $608.68 per additional credit beyond 18 |

Fees

Application and Placement fee

All students applying to take credit classes are charged a $66.00 application and placement fee. The fee is paid along with your first quarter’s tuition. Once paid, this fee is non-refundable. The fee covers application and any form of placement (transcript review or English and math placement test).

Comprehensive fee

A student voted $1.50 per credit fee ($15 maximum per quarter) is used to provide services for no additional charge. These services include (but are not limited to) transportation management, unofficial transcripts, and a catalog.

Student Transportation Fee (Garage Debt Payments)

A student voted $1.70 per credit fee ($17 maximum per quarter) to support the funding for the college parking garage and subsidize student bus passes.

Environmental Sustainability Fee

A fee of $1.00 per credit ($10 maximum per quarter). A student-body-initiated fee to fund environmental projects.

Technology fee

The technology fee ($3.50 per 1-10 credits and $3.50 per credit beyond 18) ensures credit students access to college-managed e-mail, the Internet, and many software packages in a quality academic learning environment.

Course Fees

Certain courses require fees for laboratory use, licensing, Internet service provider, etc. These fees are identified in the Credit Class Schedule; tuition and fee waivers generally do not apply.

E-learning Fee

A fee of $10.50 per credit, up to $52.50 (maximum) for a 5-credit online class pays for services, supports, infrastructure and software licensing.

E-learning Waiver

NON-RESIDENT students (limited to US citizens and permanent residents) enrolled in only online classes may be eligible for a tuition reduction. For more information e-mail enrollment@bellevuecollege.edu and ask about the “e-Learning Waiver”.

Costs for Self-Support Programs

Tuition for Self-Support Credit Programs

Some programs are self-supporting – that is, they do not receive state funding. They have their own tuition structures and do not grant tuition and fee waivers. Students pay the full tuition and fees, regardless of residency status. Self-support fees are listed with courses in the quarterly Credit Class Schedule. Self-support credit programs include upper division Interior Design, Alcohol & Drug Counseling and Fire Science.

Community Education

Fees for Community Education courses are listed in the quarterly catalog. Residency in Washington State is not required for some of these classes; in these cases, all students are charged the same stated fees regardless of residency status.

Professional Training

Fees for Tombolo Institute courses are listed in their catalog. Residency in Washington State is not required for some of these classes; in these cases, all students are charged the same stated fees regardless of residency status.

Methods of Payment

Tuition and fees may be paid with

- Visa

- MasterCard

- Discover

- check

- cash

Contact the Student Financial Services Office for more information.

Tuition and Fee Refunds

Refunds are authorized by the Washington State Legislature. The college policy offers the maximum refunds allowed by state law. Refunds are paid when a credit student withdraws from the college or when a credit student withdraws from course(s). The amount refunded will be based on credits(s) withdrawn. There is a $10.00 processing fee for refunds.

Refunds are generally processed between the 2nd and 3rd week of the quarter, but an expedited refund may be requested by filling out the online expedited refund request form (login required).

Certain fees are non-refundable

- Students withdrawn for disciplinary reasons will not be eligible for a refund.

- The refund policy does not apply to self-support courses or to noncredit Continuing Education courses (these courses may have a separate refund procedure; students should check the Continuing Education website for details).

- Tuition refunds for students receiving financial aid are processed by the Financial Aid Office and are generally returned to the program which paid the tuition.

- Complete withdrawals are processed using the federally-mandated Return of Title IV Funds for federal financial aid and a similar return occurs for state financial aid.

The college begins to process refunds after the fifth day of classes. Students may request a refund earlier by visiting or contacting Student Financial Services. See the academic/student central calendar for cut-off dates for 100% and 50% refunds. The payment method for refunds is made according to the payment method used for the original payment. If the initial payment was charged to a credit card, the refund is processed back to that credit card. Cash, check and payment plan payments are refunded by check. No checks will be processed for refunds that are less than $25; refund balances may be applied to future quarters, unless the original payment was made by a third party with other instructions. Outstanding debts to the college will be deducted from refunds. Any refund balance remaining after 8 quarters will be forfeited.

For fall, winter, and spring quarters, withdrawals are refunded as follows:

- 100% refund (minus $10.00 fee) through the fifth instructional day of the quarter

- 50% refund (minus $10.00 fee) through the 20th calendar day of the quarter

- No refunds are given after the 20th calendar day

Note: Days are prorated for summer quarter and for classes with non-standard start/end dates.

Drop for Nonpayment

Registration is not complete until payment is made. Classes may be dropped by the Registration Office for nonpayment of tuition and course related fees, including returned check and/or credit cards.

If you are dropped from classes for nonpayment, the college will notify you by email to your official BC email address.. A withdrawal fee will be charged and must be paid if you have ever been dropped for nonpayment in the past.

Related policy: (Policy #7250)

2019 – 2020 rates are tentative and once approved will be effective starting Fall quarter 2019.

| Lower Division Courses (299 & below) | Upper Division Courses (300 & above) | |||

|---|---|---|---|---|

| Credits | Resident | Non-Resident | Resident (State-Support) | Non-Resident |

| 1-10 | $110.26 | $288.13 | $215.11 per credit | $614.53 per credit |

| 11-18 | $1,102.60 for first 10 credits plus $54.58 per credit 11-18 | $2,881.30 for first 10 credits plus $61.83 per credit 11-18 | $2,151.10 for first 10 credits plus 10.78 per credit 11-18 | $6,145.30 for first 10 credits plus 11.55 per credit 11-18 |

| 19+ | $98.93 per additional credit beyond 18 | $276.80 per additional credit beyond 18 | $203.78 per additional credit beyond 18 | $603.20 per additional credit beyond 18 |

Fees

Application and Placement fee

All students applying to take credit classes are charged a $66.00 application and placement fee. The fee is paid along with your first quarter’s tuition. Once paid, this fee is non-refundable. The fee covers application and any form of placement (transcript review or English and math placement test).

Comprehensive fee

A student voted $1.50 per credit fee ($15 maximum per quarter) is used to provide services for no additional charge. These services include (but are not limited to) transportation management, unofficial transcripts, and a catalog.

Student Transportation Fee (Garage Debt Payments)

A student voted $1.70 per credit fee ($17 maximum per quarter) to support the funding for the college parking garage and subsidize student bus passes.

Environmental Sustainability Fee

A fee of $1.00 per credit ($10 maximum per quarter). A student-body-initiated fee to fund environmental projects.

Technology fee

The technology fee ($3.50 per 1-10 credits and $3.50 per credit beyond 18) ensures credit students access to college-managed e-mail, the Internet, and many software packages in a quality academic learning environment.

Course Fees

Certain courses require fees for laboratory use, licensing, Internet service provider, etc. These fees are identified in the Credit Class Schedule; tuition and fee waivers generally do not apply.

E-learning Fee

A fee of $10.50 per credit, up to $52.50 (maximum) for a 5-credit online class pays for services, supports, infrastructure and software licensing.

E-learning Waiver

NON-RESIDENT students (limited to US citizens and permanent residents) enrolled in only online classes may be eligible for a tuition reduction. For more information e-mail enrollment@bellevuecollege.edu and ask about the “e-Learning Waiver”.

Costs for Self-Support Programs

Tuition for Self-Support Credit Programs

Some programs are self-supporting – that is, they do not receive state funding. They have their own tuition structures and do not grant tuition and fee waivers. Students pay the full tuition and fees, regardless of residency status. Self-support fees are listed with courses in the quarterly Credit Class Schedule. Self-support credit programs include upper division Interior Design, Alcohol & Drug Counseling and Fire Science.

Community Education

Fees for Community Education courses are listed in the quarterly catalog. Residency in Washington State is not required for some of these classes; in these cases, all students are charged the same stated fees regardless of residency status.

Professional Training

Fees for Tombolo Institute courses are listed in their catalog. Residency in Washington State is not required for some of these classes; in these cases, all students are charged the same stated fees regardless of residency status.

Methods of Payment

Tuition and fees may be paid with

- Visa

- MasterCard

- Discover

- check

- cash

Contact the Student Financial Services Office for more information.

Tuition and Fee Refunds

Refunds are authorized by the Washington State Legislature. The college policy offers the maximum refunds allowed by state law. Refunds are paid when a credit student withdraws from the college or when a credit student withdraws from course(s). The amount refunded will be based on credits(s) withdrawn. There is a $10.00 processing fee for refunds.

Refunds are generally processed after the 3rd day of the quarter, but an expedited refund may be requested by filling out the online expedited refund request form (login required).

Certain fees are non-refundable

- Students withdrawn for disciplinary reasons will not be eligible for a refund.

- The refund policy does not apply to self-support courses or to noncredit Continuing Education courses (these courses may have a separate refund procedure; students should check the Continuing Education website for details).

- Tuition refunds for students receiving financial aid are processed by the Financial Aid Office and are generally returned to the program which paid the tuition.

- Complete withdrawals are processed using the federally-mandated Return of Title IV Funds for federal financial aid and a similar return occurs for state financial aid.

The college begins to process refunds after the fifth day of classes. Students may request a refund earlier by visiting or contacting Student Financial Services. See the academic/student central calendar for cut-off dates for 100% and 50% refunds. The payment method for refunds is made according to the payment method used for the original payment. If the initial payment was charged to a credit card, the refund is processed back to that credit card. Cash, check and payment plan payments are refunded by check. No checks will be processed for refunds that are less than $25; refund balances may be applied to future quarters, unless the original payment was made by a third party with other instructions. Outstanding debts to the college will be deducted from refunds. Any refund balance remaining after 8 quarters will be forfeited.

For fall, winter, and spring quarters, withdrawals are refunded as follows:

- 100% refund (minus $10.00 fee) through the fifth instructional day of the quarter

- 50% refund (minus $10.00 fee) through the 20th calendar day of the quarter

- No refunds are given after the 20th calendar day

Note: Days are prorated for summer quarter and for classes with non-standard start/end dates.

Drop for Nonpayment

Registration is not complete until payment is made. Classes may be dropped by the Registration Office for nonpayment of tuition and course related fees, including returned check and/or credit cards.

If you are dropped from classes for nonpayment, the college will notify you by email to your official BC email address.. A withdrawal fee will be charged and must be paid if you have ever been dropped for nonpayment in the past.

Related policy: (Policy #7250)

2018 – 2019 rates effective starting Fall quarter 2018.

| Lower Division Courses (299 & below) | Upper Division Courses (300 & above) | |||

|---|---|---|---|---|

| Credits | Resident | Non-Resident | Resident (State-Support) | Non-Resident |

| 1-10 | 107.59 per credit | 285.01 per credit | 209.98 per credit | 608.95 per credit |

| 11-18 | $1075.90 for first 10 credits plus 53.26 per credit 11-18 | $2850.10 for first 10 credits plus 60.48 per credit 11-18 | $2099.80 for first 10 credits plus 10.49 per credit 11-18 | $6089.50 for first 10 credits plus 11.23 per credit 11-18 |

| 19+ | 96.53 per additional credit beyond 18 | 273.95 per additional credit beyond 18 | 198.92 per additional credit beyond 18 | 597.89 per additional credit beyond 18 |

Fees

Application and Placement fee

All students applying to take credit classes are charged a $66.00 application and placement fee. The fee is paid along with your first quarter’s tuition. Once paid, this fee is non-refundable. The fee covers application and any form of placement (transcript review or English and math placement test).

Comprehensive fee

A student voted $1.50 per credit fee ($15 maximum per quarter) is used to provide services for no additional charge. These services include (but are not limited to) transportation management, unofficial transcripts, and a catalog.

Student Transportation Fee (Garage Debt Payments)

A student voted $1.70 per credit fee ($17 maximum per quarter) to support the funding for the college parking garage and subsidize student bus passes.

Environmental Sustainability Fee

A fee of $1.00 per credit ($10 maximum per quarter). A student-body-initiated fee to fund environmental projects.

Technology fee

The technology fee ($3.50 per 1-10 credits and $3.50 per credit beyond 18) ensures credit students access to college-managed e-mail, the Internet, and many software packages in a quality academic learning environment.

Course Fees

Certain courses require fees for laboratory use, licensing, Internet service provider, etc. These fees are identified in the Credit Class Schedule; tuition and fee waivers generally do not apply.

E-learning Fee

A fee of $10.50 per credit, up to $52.50 (maximum) for a 5-credit online class pays for services, supports, infrastructure and software licensing.

E-learning Waiver

NON-RESIDENT students (limited to US citizens and permanent residents) enrolled in only online classes may be eligible for a tuition reduction. For more information e-mail enrollment@bellevuecollege.edu and ask about the “e-Learning Waiver”.

Costs for Self-Support Programs

Tuition for Self-Support Credit Programs

Some programs are self-supporting – that is, they do not receive state funding. They have their own tuition structures and do not grant tuition and fee waivers. Students pay the full tuition and fees, regardless of residency status. Self-support fees are listed with courses in the quarterly Credit Class Schedule. Self-support credit programs include upper division Interior Design, Alcohol & Drug Counseling and Fire Science.

Continuing Education

Fees for Continuing Education classes are listed in the quarterly Continuing Education schedule. Residency in Washington State is not required for some of these classes; in these cases, all students are charged the same stated fees regardless of residency status.

Methods of Payment

Tuition and fees may be paid with

- Visa

- MasterCard

- Discover

- check

- cash

Contact the Student Financial Services Office for more information.

Tuition and Fee Refunds

Refunds are authorized by the Washington State Legislature. The college policy offers the maximum refunds allowed by state law. Refunds are paid when a credit student withdraws from the college or when a credit student withdraws from course(s). The amount refunded will be based on credits(s) withdrawn. There is a $10.00 processing fee for refunds.

Refunds are generally processed after the 3rd day of the quarter, but an expedited refund may be requested by filling out the online expedited refund request form (login required).

Certain fees are non-refundable

- Students withdrawn for disciplinary reasons will not be eligible for a refund.

- The refund policy does not apply to self-support courses or to noncredit Continuing Education courses (these courses may have a separate refund procedure; students should check the Continuing Education website for details).

- Tuition refunds for students receiving financial aid are processed by the Financial Aid Office and are generally returned to the program which paid the tuition.

- Complete withdrawals are processed using the federally-mandated Return of Title IV Funds for federal financial aid and a similar return occurs for state financial aid.

The college begins to process refunds after the fifth day of classes. Students may request a refund earlier by visiting or contacting Student Financial Services. See the academic/student central calendar for cut-off dates for 100% and 50% refunds. The payment method for refunds is made according to the payment method used for the original payment. If the initial payment was charged to a credit card, the refund is processed back to that credit card. Cash, check and payment plan payments are refunded by check. No checks will be processed for refunds that are less than $25; refund balances may be applied to future quarters, unless the original payment was made by a third party with other instructions. Outstanding debts to the college will be deducted from refunds. Any refund balance remaining after 8 quarters will be forfeited.

For fall, winter, and spring quarters, withdrawals are refunded as follows:

- 100% refund (minus $10.00 fee) through the fifth instructional day of the quarter

- 50% refund (minus $10.00 fee) through the 20th calendar day of the quarter

- No refunds are given after the 20th calendar day

Note: Days are prorated for summer quarter and for classes with non-standard start/end dates.

Drop for Nonpayment

Registration is not complete until payment is made. Classes may be dropped by the Registration Office for nonpayment of tuition and course related fees, including returned check and/or credit cards.

If you are dropped from classes for nonpayment, the college will notify you by email to your official BC email address.. A withdrawal fee will be charged and must be paid if you have ever been dropped for nonpayment in the past.

Related policy: (Policy #7250)

| Lower Division Courses (299 & below) | Upper Division Courses (300 & above) | |||

|---|---|---|---|---|

| Credits | Resident | Non-Resident | Resident (State-Support) | Non-Resident |

| 1-10 | $116.05 per credit | $299.12 per credit | $226.53 per credit | $637.35 per credit |

| 11-18 | $1,160.50 for first 10 credits plus $57.46 per credit 11-18 | $2,991.20 for first 10 credits plus $64.92 per credit 11-18 | $2,265.30 for first 10 credits plus $11.30 per credit 11-18 | $6,373.50 for first 10 credits plus $12.10 per credit 11-18 |

| 19+ | $104.12 per additional credit beyond 18 | $287.19 per additional credit beyond 18 | $214.60 per additional credit beyond 18 | $625.42 per additional credit beyond 18 |

| Lower Division Courses (299 & below) | Upper Division Courses (300 & above) | |||

|---|---|---|---|---|

| Credits | Resident | Non-Resident | Resident (State-Support) | Non-Resident |

| 1-10 | $119.13 per credit | $306.92 per credit | $232.26 per credit | $653.27 per credit |

| 11-18 | $1,191.30 for first 10 credits plus $58.94 per credit 11-18 | $3069.20 for first 10 credits plus $66.61 per credit 11-18 | $2,322.60 for first 10 credits plus $11.67 per credit 11-18 | $6,532.70 for first 10 credits plus $12.52 per credit 11-18 |

| 19+ | $106.88 per additional credit beyond 18 | $294.67 per additional credit beyond 18 | $220.01 per additional credit beyond 18 | $641.02 per additional credit beyond 18 |

| Lower Division Courses (299 & below) | Upper Division Courses (300 & above) | |||

|---|---|---|---|---|

| Credits | Resident | Non-Resident | Resident (State-Support) | Non-Resident |

| 1-10 | $123.58 per credit | $317.95 per credit | $240.10 per credit | $674.70 per credit |

| 11-18 | $1,235.80 for first 10 credits plus $61.02 per credit 11-18 | $3,179.50 for first 10 credits plus $68.96 per credit 11-18 | $2,401.00 for first 10 credits plus $12.33 per credit 11-18 | $6,747.00 for first 10 credits plus $13.25 per credit 11-18 |

| 19+ | $110.87 per additional credit beyond 18 | $305.24 per additional credit beyond 18 | $227.39 per additional credit beyond 18 | $661.99 per additional credit beyond 18 |

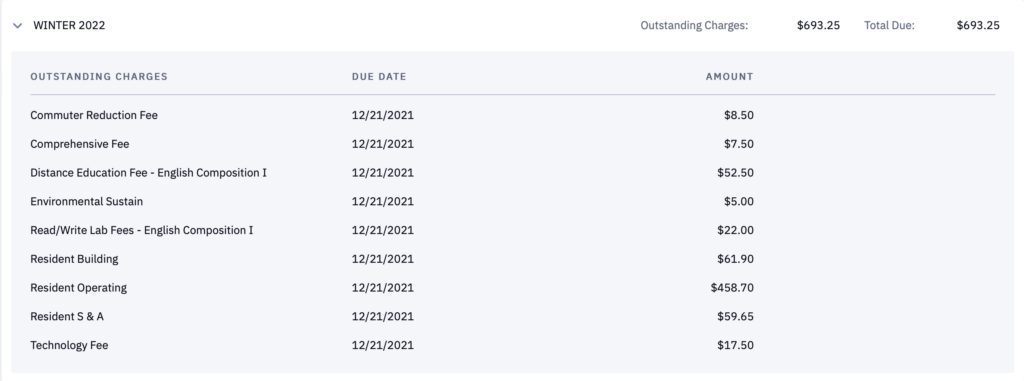

Tuition Description

Tuition is made up of three parts:

- The Operating Fee, which supports college operations,

- The Building Fee, which supports infrastructure and innovation, and

- The Services and Activities (S&A) Fee, which supports students activities and programs.

Please note that you will see these 3 parts of tuition charges broken out separately on your account in ctcLink along with “resident” or “non-resident.” Resident does not refer to housing charges but instead reflects your residency status for tuition purposes.

In addition to tuition, most students have other fees included on their accounts, which includes mandatory college fees and course fees if applicable. For detailed information about fees, please see Description of Fees page.

Example of how tuition and fee charges appear in ctcLink is below

Cost of Attendance

The Cost of Attendance is an estimate of expenses while you are enrolled at Bellevue College. These expenses determine the amount of financial aid that can be provided and are used to measure financial need.

Non-Resident E-Learning Waiver

Eligible non-resident students taking only online classes may qualify for a reduction in non-resident tuition. To receive the waiver students must:

- Be a US citizen or permanent resident,

- Ask for the waiver by submitting an Online Help Request Ticket to Enrollment Services

| Credits | Lower-division tuition amount | Upper-division tuition amount |

|---|---|---|

| 1-10 | 140.92 per credit | 257.44 per credit |

| 11-18 | 61.02 per credit | 13.25 per credit |

| 19+ | 106.88 per credit | 220.01 per credit |

Public Disclosure

Washington State institutions of higher education must provide certain information to all undergraduate resident students (RCW 28B.15.0681(5)(a) and (b).

View a disclosure of all institutional revenue received during the prior academic or fiscal year (HB 1795 Disclosure), including but not limited to state, federal, local, and private sources. It also includes the uses of tuition revenue collected during the prior academic or fiscal year by program category as determined by the office of financial management.